Create and manage Tax Rules

PUQcloud Panel

Order Now | Download | FAQ

This guide shows you how to set up and maintain Tax Rules for different countries and regions in the PUQcloud Panel. Use these rules to automatically apply the correct taxes on invoices based on the client type and location.

Overview

How matching works

The system reads rules from top to bottom. The first matching rule is applied. Keep your most specific rules (e.g., province/state) above more general ones.

Before You Start

-

Make sure you have at least one Home Company configured (Settings → Finance → Home Companies).

-

Know your target tax rates (GST/HST/PST/VAT, etc.).

-

Decide which client types the rule should apply to:

-

Private Client (individual)

-

Company Without TAX ID

-

Company With TAX ID

-

Always verify rates with your accountant or the official tax authority.

Quick Start: Generate Preset Rules

You can auto-create a starting set of rules and then fine‑tune them.

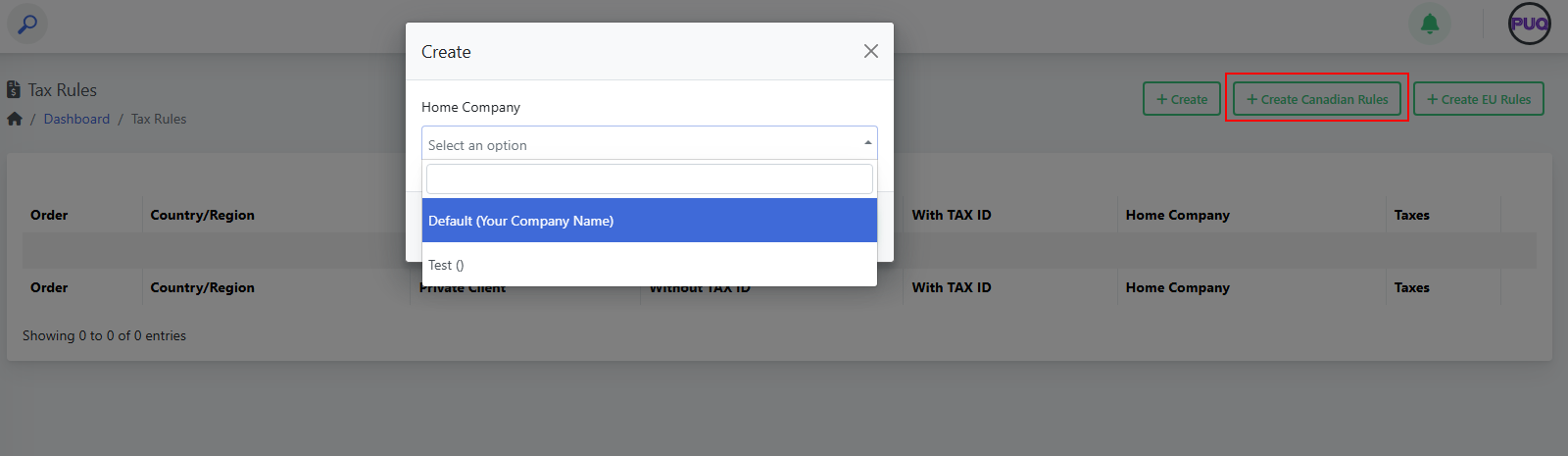

Create Canadian Rules

-

Go to Finance → Tax Rules.

-

Click Create Canadian Rules.

-

Select your Home Company and Save.

-

Review the generated rules and adjust rates as needed.

(Screenshot reference: “Create Canadian Rules” modal)

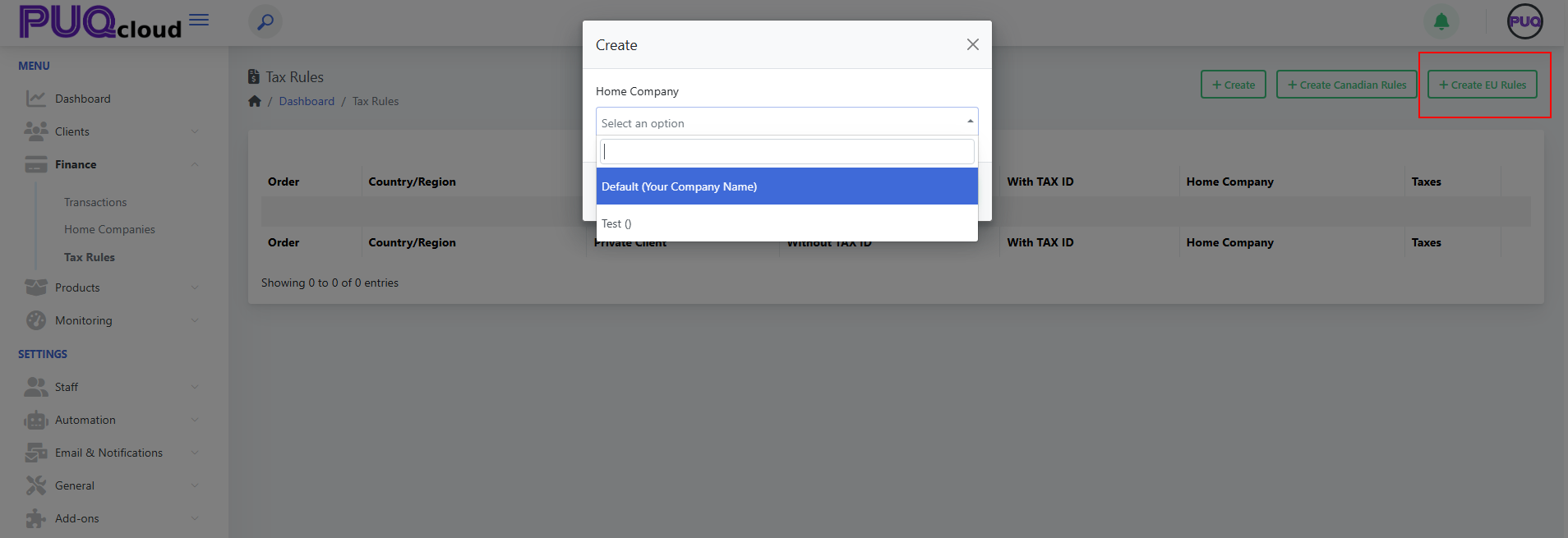

Create EU Rules

-

Go to Finance → Tax Rules.

-

Click Create EU Rules.

-

Select your Home Company and Save.

-

Review the generated rules and adjust rates as needed.

(Screenshot reference: “Create EU Rules” modal)

Note: Presets are a convenience. You are responsible for validating the final rates.

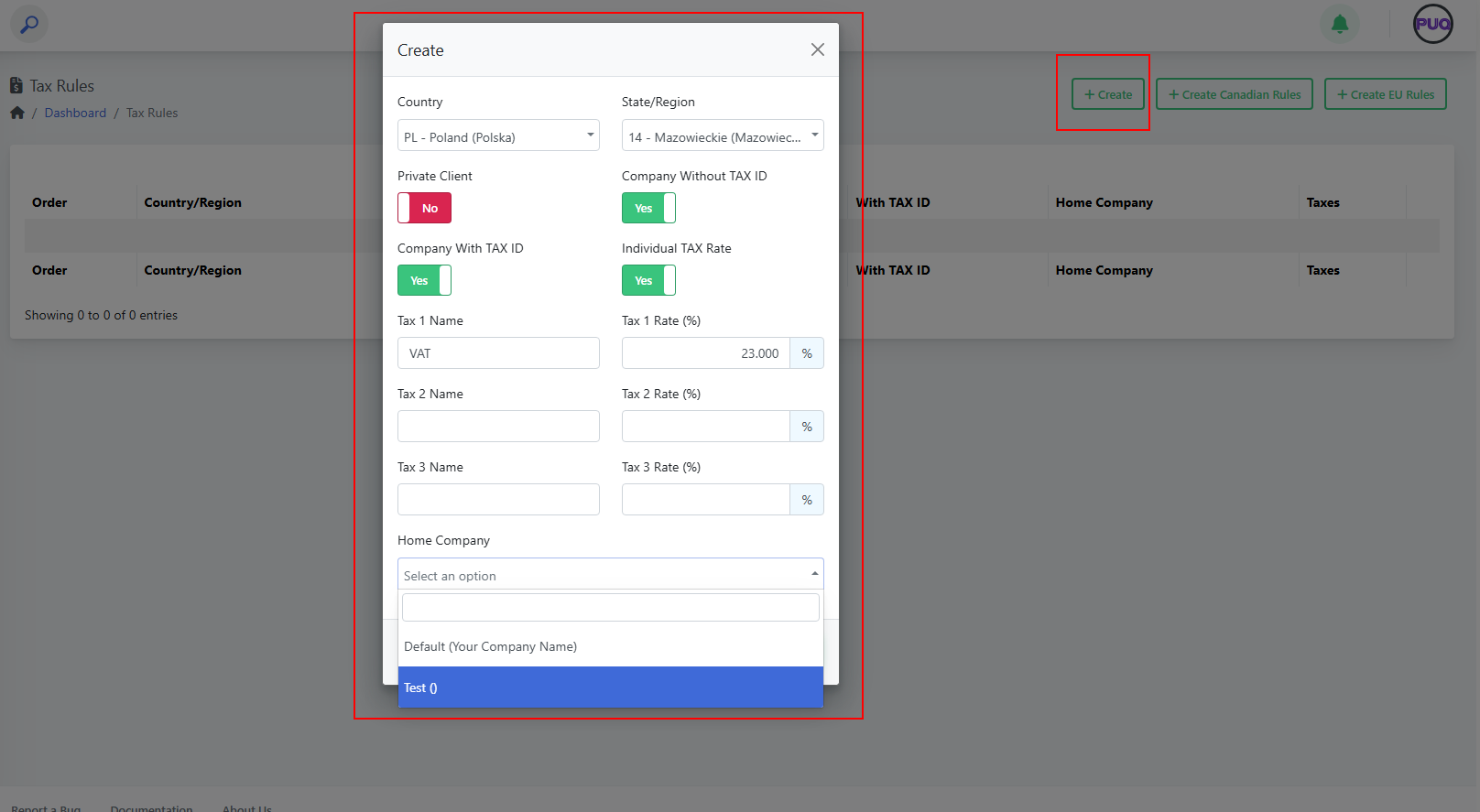

Create a Tax Rule Manually

-

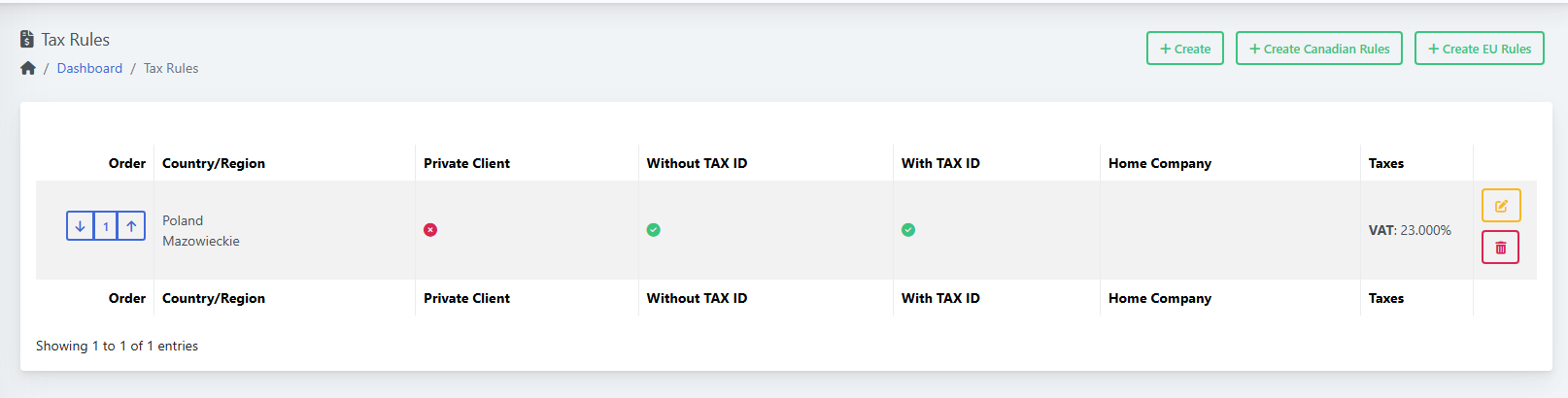

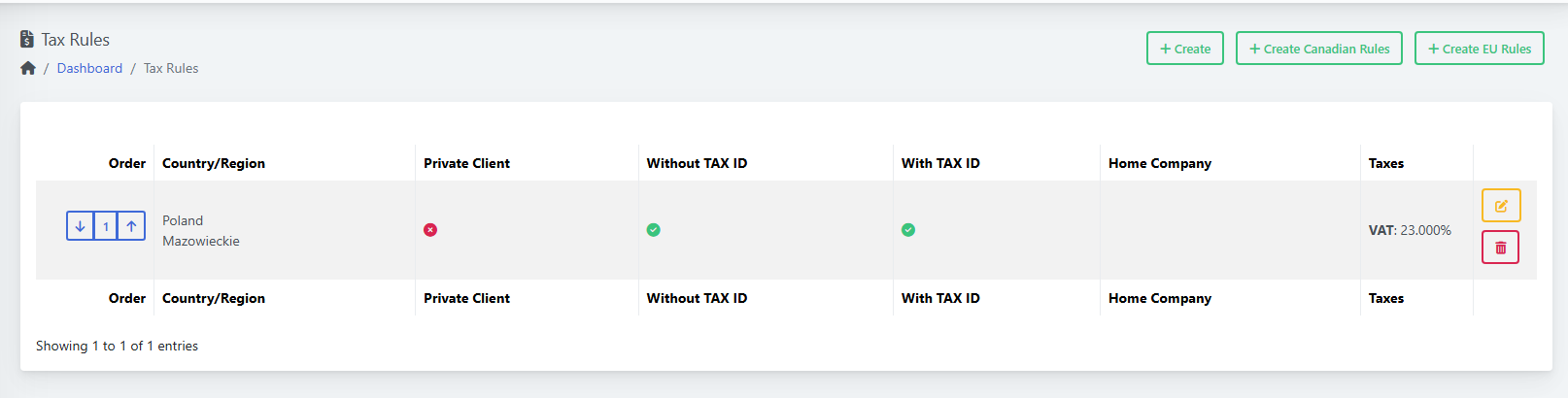

Open Finance → Tax Rules. (See: List view)

-

Click Create. (See: “Create” modal)

-

Fill the fields:

-

Country and State/Region (optional).

-

Turn on the client‑type toggles the rule should apply to:

Private Client, Company Without TAX ID, Company With TAX ID.

(Use Individual TAX Rate if the rule should tax individuals.) -

Enter up to three taxes (name + percent). Example:

-

Tax 1 Name:

VAT— Tax 1 Rate:23.000 -

Tax 2 Name:

PST— Tax 2 Rate:7.000(if applicable) -

Tax 3 Name:

GST— Tax 3 Rate:5.000(if applicable)

-

-

Choose Home Company.

-

-

Click Save. Your rule appears in the list. (See: List after creating a rule)

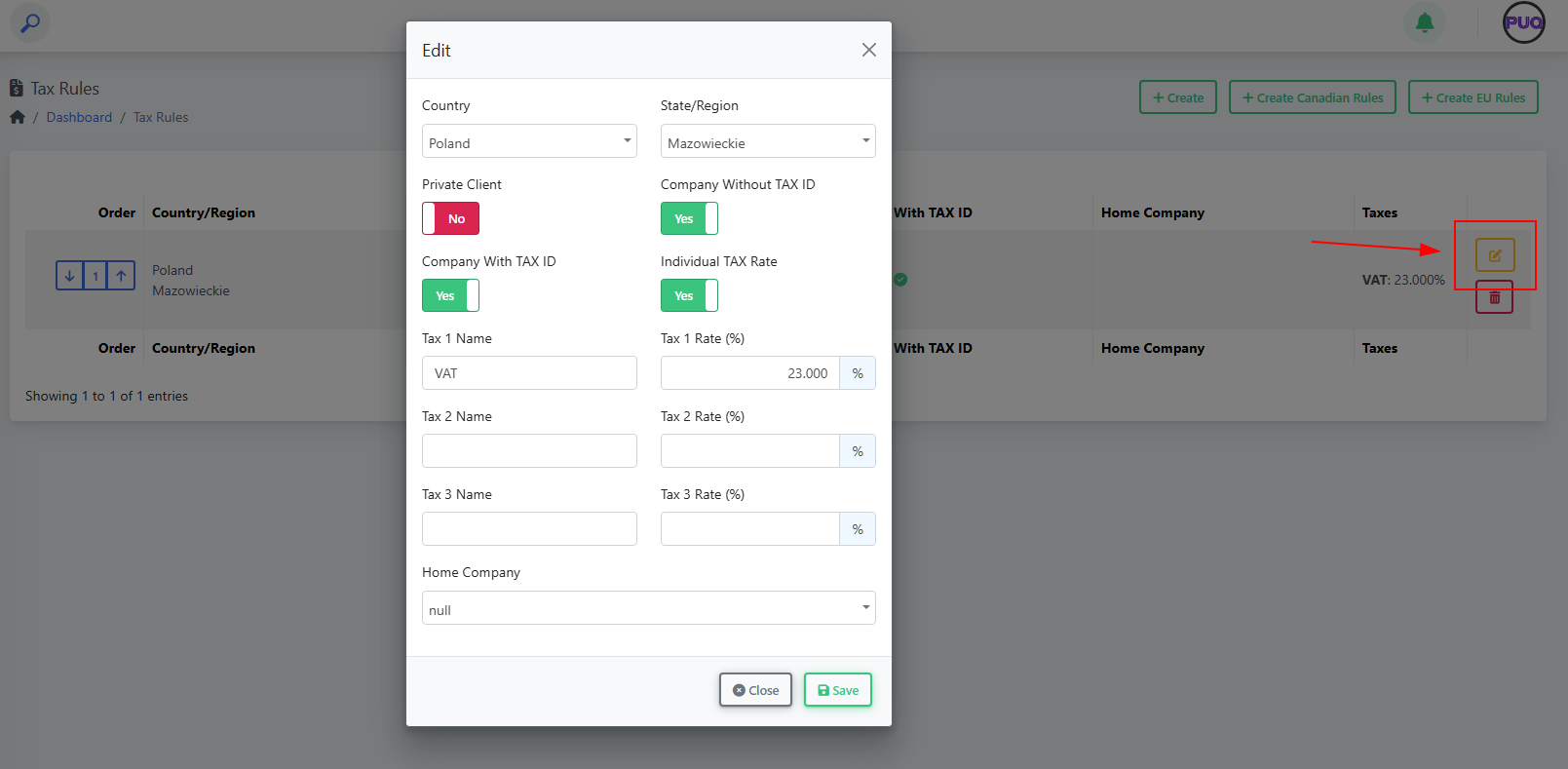

Edit a Rule

-

In Finance → Tax Rules, click the Edit icon on the desired row.

-

Change any fields (country/region, toggles, tax names/rates, home company).

-

Click Save.

(Screenshot reference: “Edit” modal)

Delete a Rule

-

In Finance → Tax Rules, click the Delete (trash) icon on the row.

-

Confirm the deletion.

Deleting a rule does not change past invoices; it only affects new invoices going forward.

Change Rule Order (Priority)

-

In Finance → Tax Rules, use the up/down arrows in the Order column.

-

Place specific rules (e.g., province/state) above general country-wide rules.

Field Reference

| Field | Type | What it controls | Example |

|---|---|---|---|

| Country | Dropdown | The country the rule applies to. | Poland |

| State/Region | Dropdown | Optional region/province/state inside the country. | Mazowieckie |

| Private Client | Toggle | Apply this rule to individuals. | On |

| Company Without TAX ID | Toggle | Apply when client is a company without a valid tax ID. | On |

| Company With TAX ID | Toggle | Apply when client is a company with a valid tax ID. | On |

| Individual TAX Rate | Toggle | Enable taxation for individuals per this rule. | On |

| Tax 1 Name / Rate (%) | Text / Number | First tax component name and percentage. | VAT / 23.000 |

| Tax 2 Name / Rate (%) | Text / Number | Second tax component (if needed). | PST / 7.000 |

| Tax 3 Name / Rate (%) | Text / Number | Third tax component (if needed). | GST / 5.000 |

| Home Company | Dropdown | Which Home Company owns/uses this rule. | Default (Your Company Name) |

Example: Poland → Mazowieckie (VAT 23%)

-

Create a rule.

-

Country: Poland; State/Region: Mazowieckie.

-

Toggles: Private Client = Off (if you only tax businesses), Company Without TAX ID = On, Company With TAX ID = On.

-

Tax 1 Name: VAT; Tax 1 Rate: 23.000.

-

Select Home Company.

-

Save. (See: List after creating a rule)

Tips & Good Practices

-

Keep a country-wide rule at the bottom and region‑specific rules above it.

-

Use clear tax names: VAT, GST, PST, HST.

-

Review rules after tax law changes or when you expand to new regions.

-

For multi‑company setups, double‑check the Home Company on each rule.

Troubleshooting

-

My client is taxed incorrectly

-

Check rule order (a broader rule may be matched first).

-

Verify the client’s country/region and tax ID status.

-

Confirm the toggles (Private/With ID/Without ID) match your intent.

-

Ensure tax rates are numeric (e.g.,

23.000).

-

-

I don’t see my Home Company

-

Create it in Home Companies and then return to Tax Rules.

-

Screenshot References

-

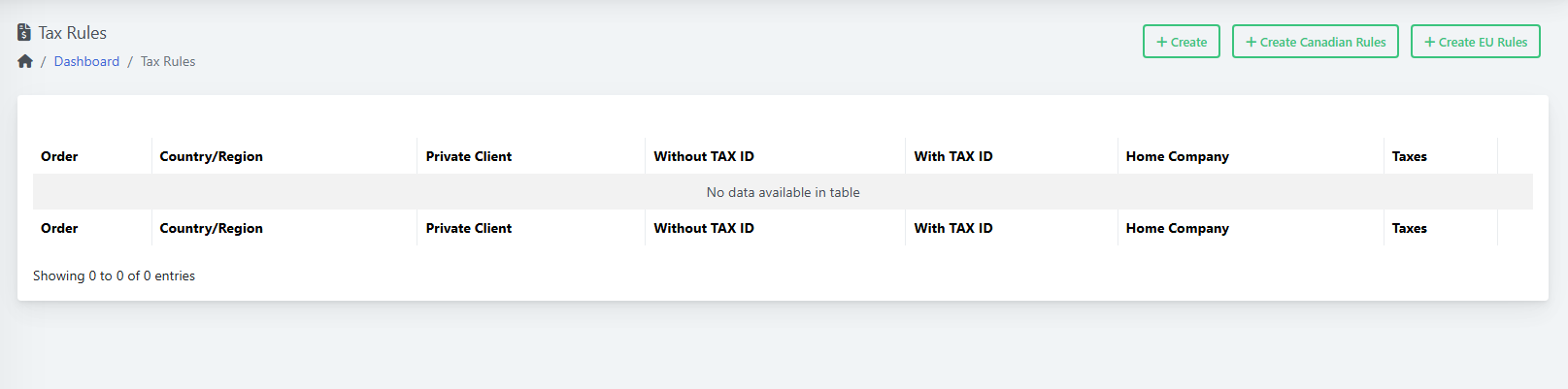

List view (empty) — overall layout and action buttons (Create, Create Canadian Rules, Create EU Rules).

-

Create modal — full form with toggles and tax fields.

-

Create Canadian Rules modal — select Home Company.

-

Create EU Rules modal — select Home Company.

-

List view (after creating) — shows Poland/Mazowieckie, indicators and VAT 23.000%.

-

Edit modal — modify existing rule fields.

No Comments