Configuration

PUQ Customization module WHMCS

Order now | Download | FAQ

Enabled - Enabling or disabling all custom functions of this extension affects the automation and visibility of its features in the client area. When extension disabled, the automation capabilities and related features provided by the extension will not be active or visible to clients. However, as an administrator, you will still have access to configure and utilize the extension's functionalities through the administration interface. This gives you the flexibility to control the visibility and automation aspects of the extension based on your specific needs and preferences.

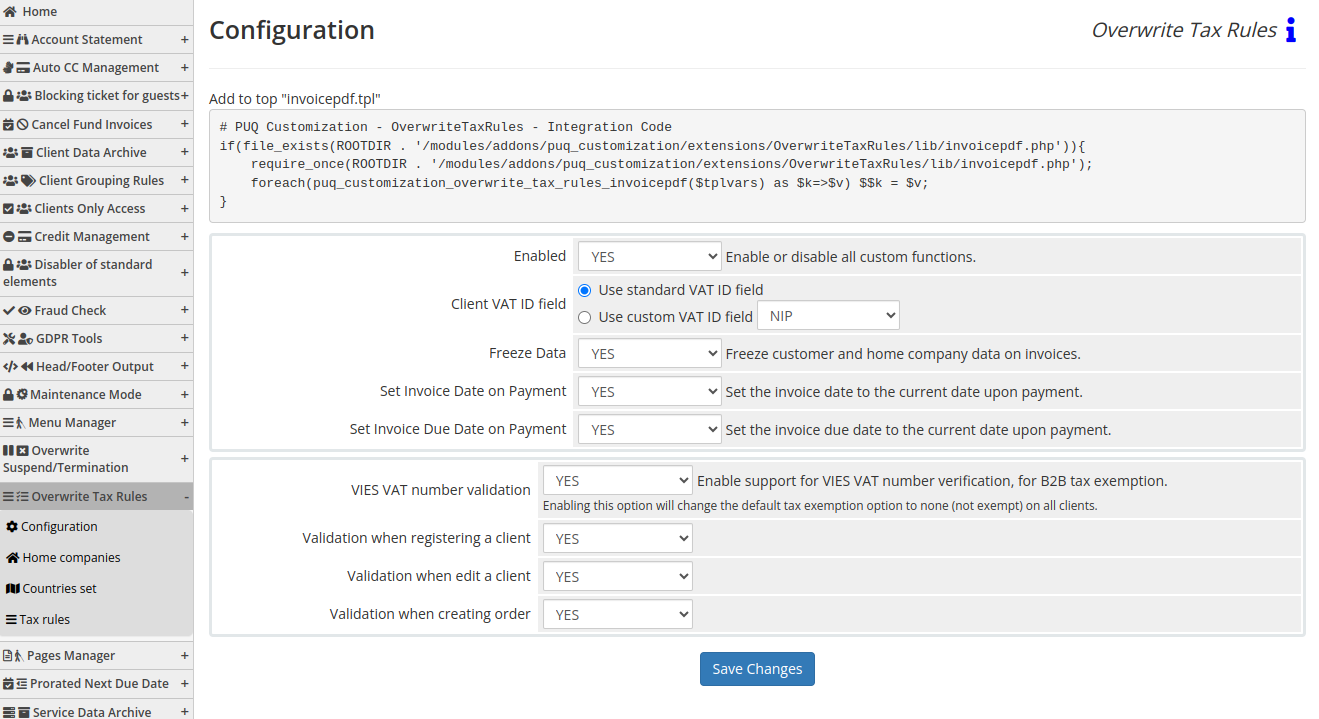

On the configuration page, you will find the following settings:

-

PUQ Customization - OverwriteTaxRules - Integration Code: This is a PHP code snippet named "PUQ Customization - OverwriteTaxRules - Integration Code." It serves as a hint for users to add this code to the top of their invoice template.

-

Client VAT ID field: This setting allows you to choose between using the standard VAT ID field or a custom VAT ID field for clients.

-

Freeze Data: This option can be set to "YES" or "NO." When enabled, the system will populate invoices with the frozen data that was captured when the invoice was created. Note that data is always frozen, but this option controls whether it is displayed on the invoice.

-

Set Invoice Date on Payment: When set to "YES," the invoice date will be automatically set to the current date upon payment.

-

Set Invoice Due Date on Payment: Similarly, when set to "YES," the invoice due date will be automatically set to the current date upon payment.

-

VIES VAT number validation: Enabling this option allows for support of VIES VAT number verification for B2B tax exemption. Please note that activating this option will change the default tax exemption option to "none" (not exempt) for all clients.

-

Validation when registering a client: This setting determines whether VIES VAT number validation is performed when registering a client. It can be set to "YES" or "NO."

-

Validation when editing a client: Similarly, this setting controls VIES VAT number validation when editing a client's information.

-

Validation when creating an order: This setting determines whether VIES VAT number validation is performed when creating an order.

These configuration options provide flexibility and control over various aspects of the "Overwrite Tax Rules" extension's functionality.

No Comments