Tax rules

PUQ Customization module WHMCS

Order now | Download | FAQ

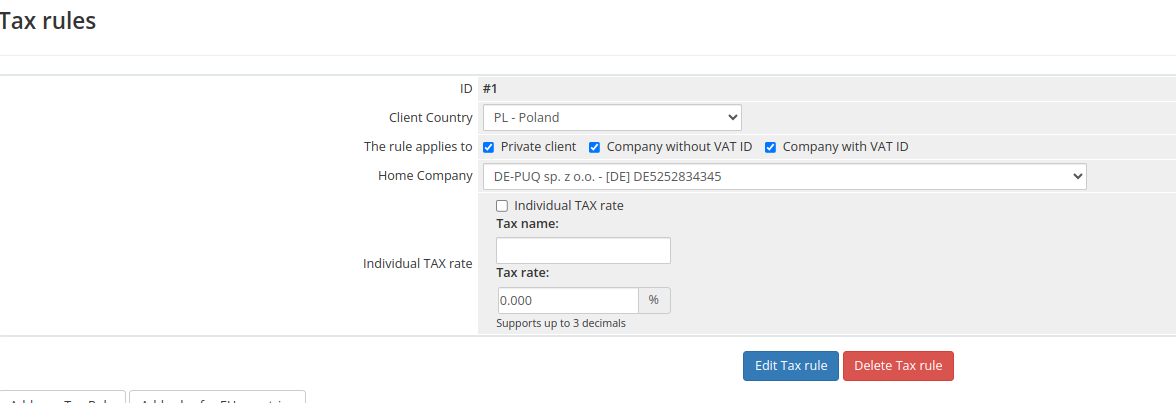

On the "Tax Rules" page, you can add tax rules, each of which allows you to specify the following parameters:

-

Client Country: This field determines the country or set of countries to which the tax rule applies. You can select a specific country or a predefined set of countries.

-

The rule applies to: This parameter defines the type of client to whom the tax rule applies. You can choose from the following options:

- Private client

- Company without VAT ID

- Company with VAT ID

-

Home Company: This field specifies the home company that serves clients falling under this tax rule. You can select the appropriate home company from the available options.

-

Individual TAX (Tax name, Tax rate): If you need to apply an individual tax with a specific name and rate to clients matching this rule, you can enter the tax name and rate in this section. This allows for customized tax calculations for clients assigned to this tax rule.

On the "Tax Rules" page, you can also manage the order of tax rules. To move a rule down, click the arrow-down button next to the corresponding rule. To move a rule up, click the arrow-up button on the respective rule.

Please note that the order of rules is crucial as they are applied from top to bottom. The rules are evaluated each time an invoice is created or transitions to the "Paid" state.

No Comments