Static Data

PUQ Customization module WHMCS

Order now | Download | FAQ

Please ensure to fill in these details with your accounting department to ensure all data complies with regulations, and perform checks before sending to Uzhondu.

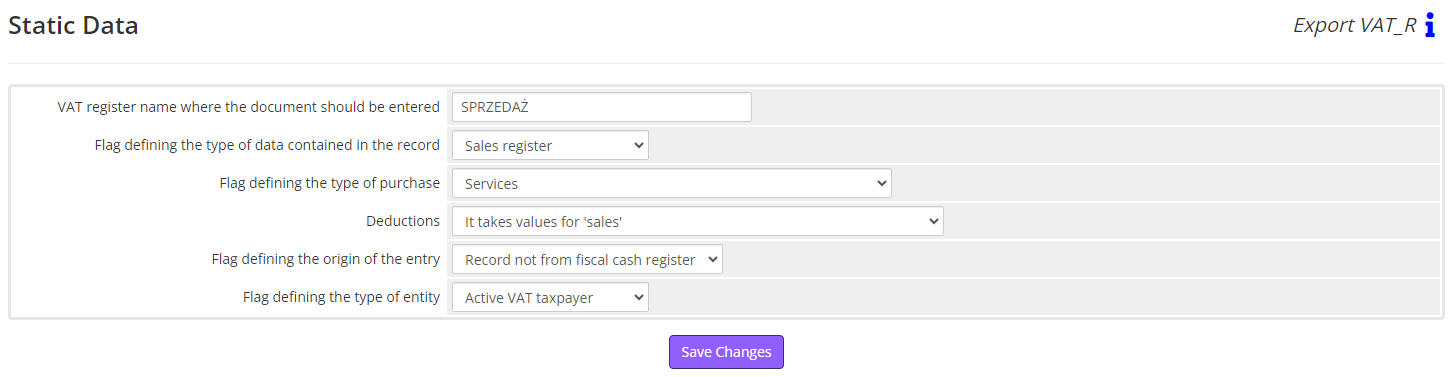

Static data - these are the details we assign to all invoices and remain unchanged regardless of the invoices, namely:

- VAT register name where the document should be entered

- Flag defining the type of data contained in the record

- Purchase register

- Sales register

- Cost ledger item

- Revenue ledger item

- Flag defining the type of purchase

- Value provided for transactions of type (field TYPE) 2, 3, and 4

- Purchase of goods for resale

- Other purchases

- Purchase of fixed assets

- Services

- Purchase of means of transport

- Purchase of real estate

- Purchase of fuel

- Deductions

- It takes values for 'sales'

- Does not take values for 'sales'

- Takes values for 'sales' only in nominative case

- Three-party transaction (only if 'EXPORT' - intra-Community delivery)

- The buyer is a taxpayer

- Purchase from a taxpayer not domiciled in Poland (only if 'EXPORT' - intra-Community delivery or export)

- To be settled in the VAT-UE declaration

- The buyer is a taxpayer (only if 'EXPORT' - intra-Community delivery or export) or three-party transaction (only if 'EXPORT' – domestic transaction)

- Flag defining the origin of the entry

- Record not from fiscal cash register

- Record from fiscal cash register

- Flag defining the type of entity

- Inactive VAT taxpayer

- Individual

- Active VAT taxpayer

No Comments